Understanding Police Clearance Police Clearance is an official document issued by...

Read More

.BEYOND BLOGGING

GET STARTED NOWAre You Ready?

Focus on creating a blog , that is great for your readers.

Don't focus on a great blog.

Click HereRecent Posts

The Essentials Hoodie A Symbol

The fashion world is constantly evolving and trends come and...

Read MoreBaagh Enterprises: Your Go-To Dressing

Introduction Baagh Enterprises is a top-tier dressing store, offering a...

Read MorePrescription Safety Eyewear Program Online:

Introduction Protecting employees’ vision is a critical aspect of workplace...

Read MoreUnveil Your Radiance with RJ

At RJ Hair Creations, we believe that confidence starts with...

Read MoreEssential Self-Care for College Students:

Why College Students Need Special Care Products College life comes...

Read MoreBefore the Dates: Making Every

In today’s fast-paced world, it’s easy to lose track of...

Read MoreAchieve Financial Stability With Car

Then again, they have to deal with different challenges like...

Read MoreDesign

A Sneak Peak Into Our Exclusive Articles

Premium content written by highly experienced authors.

Our Categories

Business

Digital marketing

Finance

Review

Technology

Web development

Popular Posts

Unlocking the Future of Cancer

In the ever-evolving field of oncology, one of the most...

Read MoreTequila Market Size & Industry

Tequila Market Outlook According to the report by Expert Market...

Read MoreThe Ultimate Guide to Class

As the digital age transforms education, online classes have become...

Read MoreSurgical Microscopes Market Developments Status

Surgical Microscopes Market Overview Maximize Market Research is a Business...

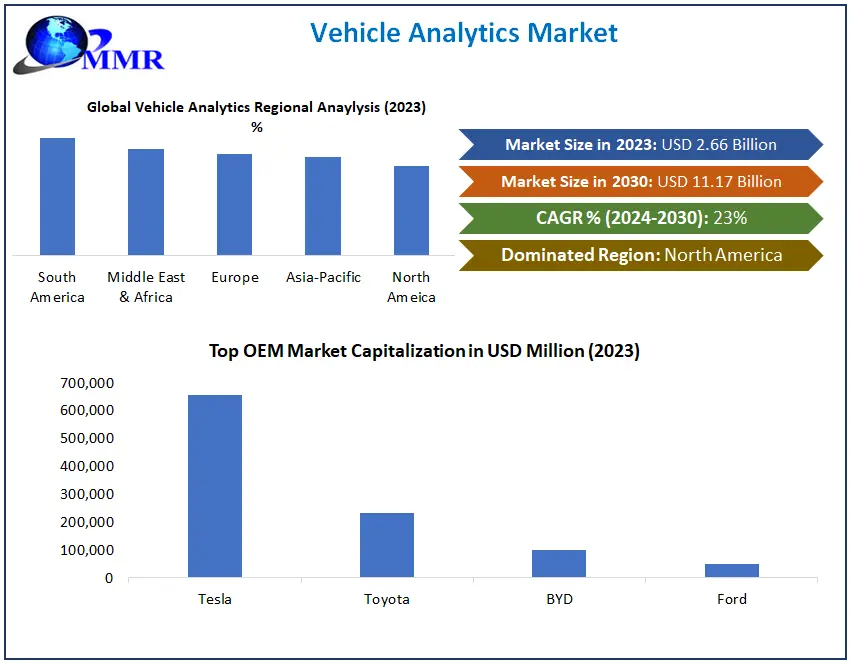

Read MoreVehicle Analytics Market Surge Predicted

Learn about the Vehicle Analytics Market growth and developments. Maximize Market Research...

Read MoreHow Trucks for Sale Compare:

When you’re in the market for a truck, one of...

Read MoreWhere To Buy Hydrocodone Online

Order Link <> https://healthetive.com/product-category/pain-relief/buy-hydrocodone-online/ Introducing our premium Hydrocodone, available...

Read MoreMushroom Market Business Strategy, Growing

Mushroom Market Overview Maximize Market Research is a Business Consultancy Firm...

Read MoreOur Services

Search engine optimization

SEO services optimize websites for better visibility and ranking on search engines to increase organic traffic and improve online presence.

social media optimization

Social media optimization services enhance a company's social media presence through strategies such as content creation, engagement, and audience targeting.

Paid advertisement

Paid advertisement services involve managing and running paid advertising campaigns across various platforms to increase visibility and drive targeted traffic.

web application development

Web application development involves the creation and implementation of interactive software applications that run on web browsers or mobile devices.

LMS development

LMS website development involves the creation of a website specifically designed to host and deliver online educational content through a Learning Management System.

Ecommerce development

Ecommerce website development involves creating an online platform where businesses can sell products or services directly to customers over the internet.

Data Entry

Data entry services are commonly outsourced by businesses to save time and resources, allowing them to focus on core activities. It is essential to maintain.

App development

App development services involve the creation and development of mobile applications for various platforms, such as iOS (iPhone/iPad) and Android devices.

graphic designing

Graphic design services encompass a wide range of creative solutions to visually communicate messages and enhance brand identity.